All Industries

Background Check

Banking

Gig Economy

Lending

Mortgage

All Customers

Only Case Studies

Powering fast, fair background checks for businesses of all sizes

With Argyle, Checkr completes employment verifications in 15 seconds — down from 1-4 days

Background Check

The comprehensive business app for independent workers

With Argyle, Solo tracks income from connected gig platforms for seamless dashboard management

Gig Economy

Helping service people and military families become homeowners

With Argyle, VU automates parts of the origination process, for a better, more efficient experience

Mortgage

A KYC and fraud prevention platform for financial services

With Argyle, Alloy helps customers approve more applicants through alternative underwriting data

Lending

Offering instant, automatic verifications of credit applications

With Argyle, Informed gives lenders real-time data so they can make smarter, real-time decisions

60+ years serving members, their families, and communities of Georgia

With Argyle, GUCU makes home buying and refinancing quick, easy, and achievable

Mortgage

Where members are neighbours and down payments are low

With Argyle, income and employment verification has never been faster — or more borrower-friendly

Mortgage

Making straightforward personal loans accessible to more borrowers

With Argyle, verifying the income of hardworking borrowers is easier and more reliable

Lending

A one-stop screening and compliance solution trusted by 30% of F500

A one-stop screening and compliance solution trusted by 30% of F500

Mortgage

Home loans with dedicated loan officers and unmatched service

With Argyle, borrowers are able to complete the loan process on time and from the palm of their hand

Making home loans simple for current and aspiring homeowners

With Argyle, Acopia gets instant access to high-quality income data, instead of costly reports from TWN

A financial fitness tool helping consumers reach mortgage readiness

With Argyle, Finlocker empowers customers to present themselves to lenders as verified borrowers

Mortgage

Multistate lender offering an easy, reliable mortgage loan experience

With Argyle, NFM Lending simplifies document collection and eliminates paper processing for quicker closings

Mortgage

A trusted world leader in digital payment technology

With Argyle, GDS customers have access to better income data for faster, more profitable decisions

Mortgage

Providing our members with honest value, superior service and trusted advice

Argyle executed a custom integration hitting on pain points so DCCU could provide an outstanding member experience

Mortgage

A platform changing the way money moves between employer and employee

With Argyle, shift-level visibility into hours worked enables instant access to earned pay

Earned Wage Access

Lending

OUR PARTNERS

We also work with leading companies to bring our customers best-in-class experiences

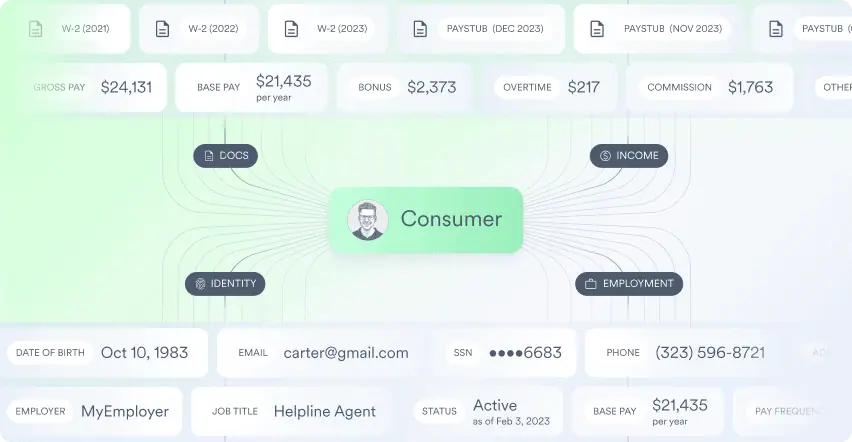

SOLUTIONS FOR YOUR INDUSTRY

Argyle is tailored to fit your

industry-specific needs

Reduce production costs, increase pipeline capacity, and shorten loan cycles.

Approve more qualified borrowers, more confidently with a better view of creditworthiness.

Accelerate approvals, dramatically lower costs, and reduce manual work.

Seamlessly fund accounts to drive assets under management.

Leverage real-time work activity to enhance products and reduce risk.